Date Published: 11/05/2025

Author: Edmundo C. Alemany

Teaching Overview - Foundations of Investing

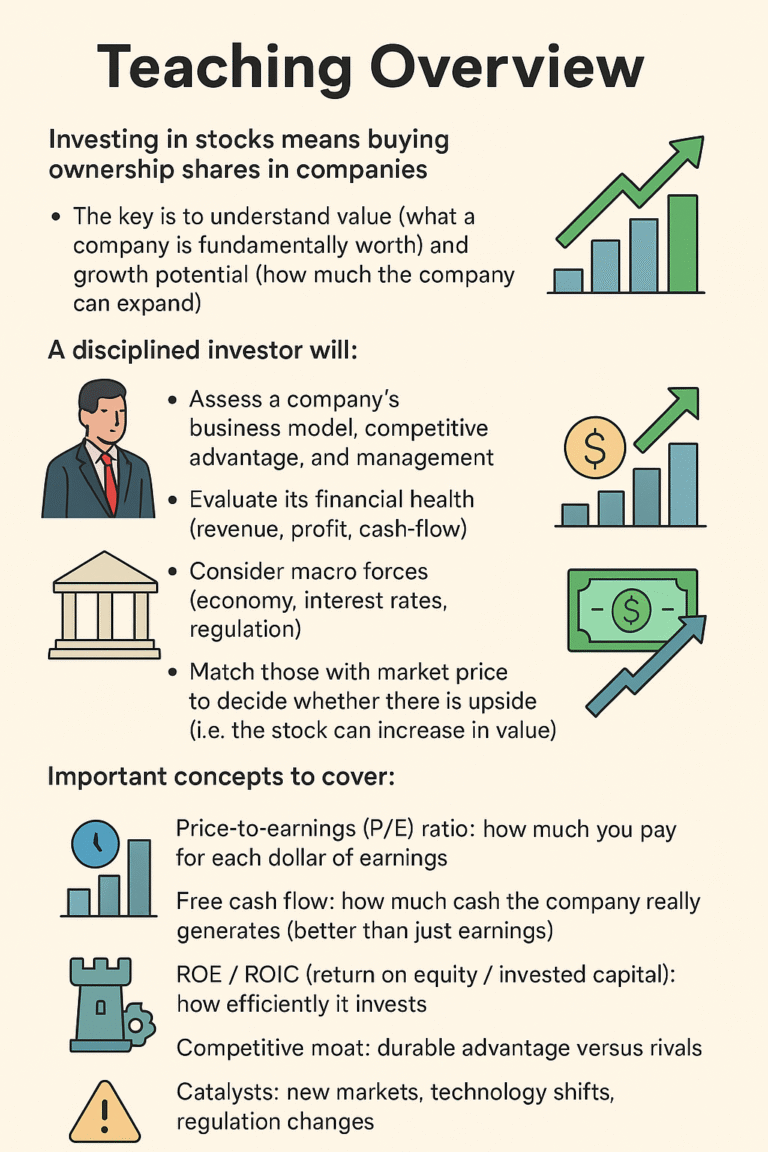

Investing in stocks represents more than simply purchasing pieces of paper or digital entries in a trading account — it is about acquiring ownership in real, functioning companies that produce products, offer services, and generate profits. When you buy a stock, you are effectively buying a fraction of a company’s future potential, both in its earnings and its intrinsic ability to grow over time. Mastering the Foundations of Investing requires understanding these principles deeply. Investing in stocks is about evaluating value, growth potential, and the causal relationships that drive business success. Knowing how to evaluate stocks effectively is key to identifying opportunities and avoiding pitfalls in stock market investing.

A disciplined investor approaches this process methodically, examining not just numbers but also the logic behind a company’s success. This means analyzing the business model, or how the company makes money; evaluating its competitive advantage, or why it can maintain profitability in the face of rivals; and assessing management quality, or how effective leadership is in executing strategies and adapting to change. These qualitative aspects must be paired with quantitative evaluation — looking at financial health through indicators like revenue growth, net profit margins, debt levels, and most importantly, cash flow. Understanding how to evaluate stocks in this way is a cornerstone of the Foundations of Investing. Investors seeking the best stocks to buy 2025 must combine these insights with forward-looking judgment to select companies with durable growth.

Beyond the company itself, a disciplined investor must consider the broader macro forces shaping the market environment. Economic cycles, inflation rates, central bank policies, and government regulations all directly influence business performance. For instance, rising interest rates might make borrowing costlier for firms, reducing profit margins, while favorable policy changes could accelerate growth in certain sectors. Applying Foundations of Investing principles here helps in both stock portfolio strategy and diversifying investments. Simultaneously, those exploring cryptocurrency investing should understand how market sentiment, regulation, and technology affect digital assets like Bitcoin, Ethereum, Solana, and Chainlink, while also identifying top crypto coins to invest in for high potential returns.

From your perspective, since you focus on rational analysis and causal reasoning rather than mystical notions like “fate” or “the universe aligning,” your teaching should emphasize logical fundamentals over superstition or hype. Investing in stocks and cryptocurrency investing should be presented as systems governed by cause and effect: corporate behavior leads to financial outcomes, which in turn affect stock performance, while blockchain adoption and network utility drive crypto price movements. Thus, the lesson to your readers should be: What concrete evidence makes a stock a good investment? Which signals indicate the best stocks to buy 2025? How to evaluate top crypto coins to invest? Learning how to evaluate stocks and implement stock portfolio strategy alongside crypto investment tips ensures readers can apply the Foundations of Investing practically and confidently.

Mastering Foundations of Investing also means understanding the interplay between traditional stock market investing and speculative cryptocurrency investing. By balancing investing in stocks with carefully selected top crypto coins to invest, and applying how to evaluate stocks methods, investors can maximize returns while controlling risk. Whether exploring Bitcoin, Ethereum, Solana, or Chainlink, or deciding which best stocks to buy 2025, the focus remains on logic, analysis, and long-term strategy.

Important Concepts to Cover

Price-to-Earnings (P/E) Ratio: This ratio tells investors how much they are paying for each dollar of a company’s earnings. A lower P/E can indicate a cheaper valuation, but it might also signal slower growth. Conversely, a higher P/E can mean investors expect faster growth but also exposes them to greater downside risk if expectations are not met. Understanding P/E in context — compared to industry peers and the company’s own historical levels — is critical for assessing whether a stock is undervalued or overvalued.

Free Cash Flow (FCF): Often more reliable than reported earnings, free cash flow measures how much real cash the company generates after accounting for capital expenditures. It’s a powerful indicator of whether a company can pay dividends, buy back shares, or reinvest in its business without taking on more debt. Companies with consistently high and growing free cash flow tend to be financially strong and better positioned to survive downturns.

Return on Equity (ROE) / Return on Invested Capital (ROIC): These metrics assess how efficiently a company turns its investments into profits. A high ROE or ROIC implies strong capital management and effective reinvestment strategies. These ratios also help identify whether a company’s profits come from genuine operational efficiency or simply from taking on more debt — a key distinction in determining sustainable value creation.

Competitive Moat: Coined by Warren Buffett, a moat represents a company’s durable competitive advantage — something that protects it from competitors. This could be brand loyalty (like Apple), network effects (like Google), intellectual property (like pharmaceutical patents), or economies of scale (like Amazon). The wider and more defensible the moat, the longer a company can maintain high profitability.

Catalysts: These are upcoming events or developments that could drive a stock’s value upward. They include launching a new product, entering a new market, technological innovation, regulatory approval, or even macroeconomic policy shifts that favor the company’s sector. Recognizing catalysts early helps investors anticipate growth rather than merely react to it.

Risk Factors: Every investment carries risk. Even strong companies can falter if their competitive edge erodes, debt levels rise unsustainably, or valuations become detached from fundamentals. Broader risks include business disruptions, macroeconomic downturns, or shocks like sudden regulatory changes. A skilled investor must always weigh potential reward against these risks, managing exposure through diversification and continuous reevaluation.

In essence, teaching your audience about investing in stocks means guiding them to move beyond surface-level excitement and into a disciplined framework of rational investigation, evidence-based decision-making, and cause-and-effect understanding. Investing is not a gamble or a spiritual journey; it’s a logical exercise in pattern recognition, risk management, and probabilistic reasoning grounded in real-world data.

Ten Stocks with Upside Potential

In this section, we’ll explore ten publicly traded companies that I personally evaluate for their growth and value potential. Each represents a blend of stability, innovation, and future opportunity. The goal here isn’t to tell you what to buy, but to teach you how to think when evaluating a company’s potential upside. You should view these examples as case studies in business models, valuation, and market psychology.

1) Apple Inc. (AAPL) - Buy Here

Why I like it: Apple remains one of the strongest examples of brand dominance in the world. Its true power lies not just in selling devices, but in creating an ecosystem that traps customers in a loop of loyalty and convenience—hardware, software, and services all connected seamlessly. This generates recurring revenue through subscriptions like iCloud, Apple Music, and Apple TV+.Value/Growth case: Despite being a mature company, Apple continues to innovate quietly. Its investments in augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) integration for devices may redefine how people interact with technology. Its financial stability and massive cash reserves make it a long-term compounder that can weather market volatility.

Risk: Apple’s valuation already prices in much of its success. Future upside will depend heavily on whether it can deliver a truly groundbreaking new product category—such as an AR headset or autonomous vehicle tech. Without that, growth could flatten.

2) Microsoft Corporation (MSFT) - Buy Here

Why I like it: Microsoft is a model of reinvention. Once known mainly for Windows and Office, it now earns a majority of its revenue from the cloud through Azure. That shift turned Microsoft into one of the biggest AI infrastructure players globally. Additionally, its integration of AI tools into Office 365 and GitHub Copilot positions it at the center of enterprise AI adoption.Value/Growth case: Microsoft combines predictable cash flow with massive growth potential. Its enterprise contracts are long-term and recurring, giving it both security and expansion ability. The continued rise of digital transformation, AI, and automation ensures its products remain essential to businesses worldwide.

Risk: Its premium valuation requires constant performance. If growth slows or regulators intervene (as they did in antitrust cases), the stock could face short-term pressure.

3) Nvidia Corporation (NVDA) - Buy Here

Why I like it: Nvidia is arguably the most transformative company in the semiconductor industry. It dominates the GPU (graphics processing unit) market, but its real value is in the AI revolution. Every AI model—from ChatGPT to autonomous driving systems—relies heavily on Nvidia’s chips. This gives it massive leverage in a rapidly growing market.Value/Growth case: Nvidia’s innovation in high-performance computing (HPC) and its CUDA software ecosystem create a high barrier to entry. It’s not just selling chips; it’s selling an entire AI platform. As cloud and enterprise AI adoption expand, Nvidia stands at the center of that infrastructure.

Risk: The semiconductor industry is cyclical. Hype-driven valuations may lead to corrections when expectations become unrealistic. Competitors like AMD and Intel are also closing in.

4) Alphabet Inc. (GOOG/GOOGL) - Buy Here

Why I like it: Alphabet, Google’s parent company, is a master of diversification. Its portfolio spans digital advertising, cloud services, and advanced research projects such as Waymo (self-driving cars) and DeepMind (AI). Few companies possess such an expansive influence over the internet ecosystem.Value/Growth case: Google Search and YouTube generate immense cash flow, which Alphabet reinvests in long-term innovation. Its leadership in AI language models positions it strongly in the next wave of digital tools. The company also benefits from owning the Android operating system, which powers over 70% of the world’s smartphones.

Risk: Alphabet faces increasing antitrust scrutiny in both the U.S. and Europe. Advertising growth can also slow in weak economies, making diversification even more important.

5) Amazon.com, Inc. (AMZN) - Buy Here

Why I like it: Amazon’s brilliance lies in vertical integration—it’s not just an e-commerce store, but a logistics powerhouse, cloud computing leader (AWS), and growing player in digital advertising. Few companies have such diversified profit engines.Value/Growth case: AWS (Amazon Web Services) continues to dominate cloud computing with margins far higher than retail. Amazon is also using machine learning to improve logistics efficiency and delivery automation. Its advertising division is growing fast, adding a high-margin revenue stream.

Risk: Thin margins on retail operations make it sensitive to consumer spending. Additionally, regulators are increasingly focused on its dominance in multiple sectors.

6) Meta Platforms, Inc. (META) - Buy Here

Why I like it: Meta remains the global leader in social media through Facebook, Instagram, and WhatsApp. What makes it particularly interesting now is its aggressive pivot toward AI and the metaverse—two major trends shaping the future of digital communication.Value/Growth case: With billions of daily users, Meta owns vast datasets ideal for AI development. Its Reality Labs division invests heavily in AR/VR technologies that could redefine human interaction in virtual environments. The ad business continues to generate large cash flows to fund innovation.

Risk: Its metaverse investments are risky and long-term. User growth has plateaued in some regions, and regulatory pressure remains high.

7) Broadcom Inc. (AVGO) - Buy Here

Why I like it: Broadcom is a powerhouse in semiconductors and infrastructure software. Its acquisition-driven strategy has helped it expand into AI chips, networking, and broadband technologies—essential components of modern computing.Value/Growth case: With its balance between chip manufacturing and software licensing, Broadcom provides investors with both growth potential and income stability. AI-related demand gives the company an opportunity for revaluation as its chips power next-gen data centers.

Risk: Hardware businesses are cyclical and capital-intensive. Any disruption in chip supply or demand can hurt profitability.

8) Shopify Inc. (SHOP) - Buy Here

Why I like it: Shopify empowers millions of small and mid-sized businesses to build their own online stores. As more entrepreneurs move online, Shopify serves as the digital backbone of independent commerce.Value/Growth case: E-commerce is still growing globally, and Shopify’s recurring subscription revenue model creates predictable income. The company continues to innovate with tools like AI-driven marketing and fulfillment networks.

Risk: Competition from Amazon and emerging players may limit margins. Global expansion requires careful execution to maintain profitability.

9) Intuitive Surgical, Inc. (ISRG) - Buy Here

Why I like it: Intuitive Surgical is a pioneer in robotic-assisted surgery. Its da Vinci systems are used worldwide, offering precision and minimally invasive procedures that improve patient recovery times.Value/Growth case: As the global population ages, demand for surgical efficiency rises. Hospitals adopting robotics often stay loyal to Intuitive due to high switching costs and established training.

Risk: Heavy R&D investment and regulatory oversight can pressure margins. The healthcare sector is also slow to adopt expensive technology in lower-income regions.

10) PayPal Holdings, Inc. (PYPL) - Buy Here

Why I like it: PayPal remains one of the most trusted names in digital payments. Its infrastructure supports millions of merchants globally and facilitates seamless online transactions. It also explores crypto integration and buy-now-pay-later (BNPL) solutions.Value/Growth case: As digital payments replace cash, PayPal’s transaction volume continues to expand. Its brand recognition, security, and user base make it a foundational fintech stock.

Risk: Competition from Apple Pay, Block (Square), and newer fintechs pressures margins. Regulation in financial technology is also intensifying.

How to Structure a Portfolio and Evaluate Stocks

A well-structured portfolio

A well-structured portfolio is not simply a random collection of stocks — it’s an intentional architecture of balance, protection, and opportunity. Teaching your readers to build one requires more than just naming good companies; it’s about teaching how to think like a strategist. Investors must design their portfolios like engineers, balancing different types of assets according to function and resilience. This approach transforms investing from a game of luck into a disciplined system of probability and control.

Start with Diversification

One of the most fundamental principles of intelligent investing is diversification. This means spreading your investments across various sectors, industries, and even geographic regions to minimize exposure to any single source of risk. When an investor goes “all in” on one theme — say, technology — they are effectively betting their future on one sector’s success or failure. A disciplined investor, by contrast, blends growth stocks (high potential but higher volatility) with value stocks (stable earnings and reliable cash flow).

Diversification functions as a risk dampener. If one area underperforms, others often compensate. For example, if tech stocks decline due to regulation or market saturation, consumer staples or healthcare might rise due to their defensive nature. The goal is to make sure that no single event or sector collapse can derail the entire portfolio.

Set Clear Time Horizons

Every investment should have a purpose and a timeline. Long-term investing (5–10 years) aligns with businesses that grow steadily and compound value over time. This time frame allows market fluctuations to smooth out and lets business fundamentals determine the outcome. Conversely, short-term trading requires constant monitoring and a very different skill set — technical analysis, timing, and risk management.

When teaching your readers, emphasize that true wealth creation through stocks usually requires patience and conviction. A great company might double its intrinsic value in five years, but the stock price will only reflect that when the market finally catches up. The impatient investor, driven by emotion, often sells early and misses that compounding effect.

Regularly Review Fundamentals

A stock should never be treated as a “buy-and-forget” asset. Markets evolve, management teams change, and new competitors emerge. Therefore, reviewing a company’s fundamentals at least quarterly is essential. Encourage your readers to reexamine key areas:

Moat Strength: Is the company still protected from competition? Has its unique advantage eroded over time?

A company’s moat represents its long-term defensive barrier against competitors. A strong moat can come from brand loyalty, patents, network effects, scale advantages, or exclusive access to resources. Teaching your readers to evaluate this means asking: Does the company have something competitors cannot easily replicate? If a company’s moat is narrowing — for example, through new entrants, commoditization of products, or technological disruption — its future profits and market share may be at risk. A shrinking moat signals that even a currently profitable company could face declining returns, making continual assessment critical. Investors should quantify the moat where possible, looking at metrics like market share stability, customer retention, and pricing power.

Debt and Liquidity: Rising debt or shrinking free cash flow can signal internal strain.

Debt is a double-edged sword: it can fuel growth, but excessive debt exposes a company to financial risk if revenues falter. Free cash flow (FCF) is the lifeblood of a company’s operations, showing whether it generates enough cash to pay down debt, reinvest, or return value to shareholders. Investors should evaluate whether debt levels are sustainable relative to earnings and FCF, and whether liquidity — cash on hand and short-term assets — is sufficient to cover obligations. A sudden rise in debt or declining FCF can indicate operational stress, poor capital management, or overleveraging, all of which increase the risk profile of a stock.

Growth Consistency: Are revenues and profits still increasing at a healthy pace?

Sustainable growth is not just about increasing revenues; it’s about maintaining a steady pace of growth in both top-line (revenue) and bottom-line (profit) metrics. Investors should examine historical trends, seasonal fluctuations, and projections for future expansion. Growth that is erratic, declining, or heavily dependent on short-term catalysts may signal vulnerability. Consistency also reflects management’s ability to execute strategies reliably, survive market cycles, and capitalize on opportunities. Teaching readers to track both absolute and percentage growth rates, margins, and compounding effects helps them distinguish between transient success and enduring business strength.

Leadership Quality: Has management remained transparent and effective in navigating challenges?

The effectiveness of a company’s leadership directly influences its long-term success. Strong leaders make strategic decisions, allocate resources efficiently, and adapt to changing environments. Teaching readers to evaluate leadership involves looking at track records, communication transparency, responsiveness to crises, and alignment with shareholder interests. Poor leadership can erode competitive advantages, mismanage capital, and create operational inefficiencies, while exceptional leaders can drive innovation, sustain growth, and enhance shareholder value even in challenging markets. Leadership quality is often a qualitative assessment, but can also be observed through measurable outcomes like operational efficiency, consistent strategy execution, and risk management.

If any of these pillars begin to weaken, the stock may no longer deserve a place in the portfolio. Selling isn’t a sign of defeat; it’s a sign of discipline.

Understand Valuation Risk

Even excellent companies can become poor investments if bought at the wrong price. Valuation risk occurs when enthusiasm inflates a stock’s price beyond its fundamental worth. For instance, a company with a P/E ratio far higher than its peers may already have its future success “priced in.” In that case, even if the company performs well, the upside may be limited because investors have already paid for perfection.

This is why teaching readers to interpret valuation metrics — such as P/E ratio:, price-to-book, or discounted cash flow (DCF) estimates — is critical. The best investors don’t chase hype; they buy when value exceeds price.

Link to Rational Causality

Because your philosophy rejects mystical explanations like destiny or universal alignment, this section should reinforce the cause-and-effect chain that governs markets. Every price movement can be traced back to an underlying process:

Business Model → Execution → Financials → Valuation → Market Return

When teaching this sequence, stress that each link must be questioned logically. A sound business model means little without execution; strong financials are meaningless if the valuation is already excessive. Market returns, therefore, are not magical — they are the logical endpoint of a continuous, measurable process.

Encourage readers to adopt the mindset of investigators rather than fortune-tellers. When they buy a stock, they are not “believing” in luck — they are making a hypothesis about cause and effect. If they are wrong, they should analyze why rather than emotionalizing the loss. This builds intellectual integrity and long-term mastery.

Cryptocurrencies – High Volatility, High Potential

Teaching Overview

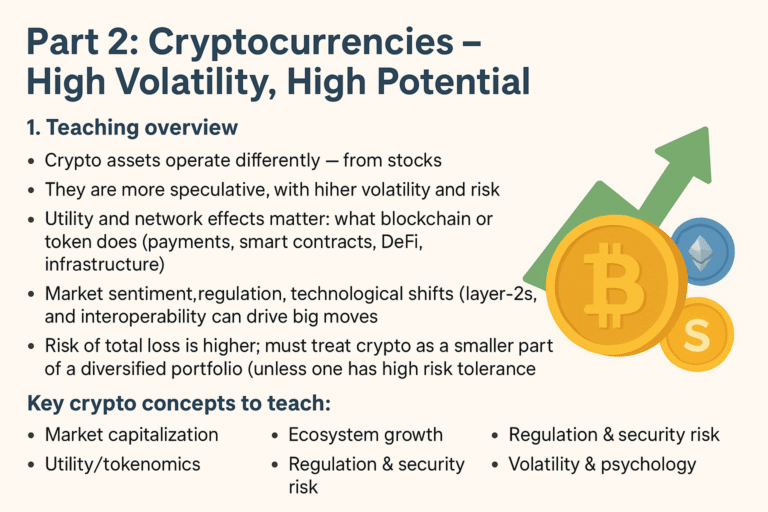

Crypto assets operate in ways that are fundamentally different from traditional stocks. Unlike stocks, which represent ownership in real companies with predictable revenue streams, cryptocurrencies are digital assets whose value often derives from utility, network effects, and market perception rather than earnings or cash flow. Teaching your readers about crypto requires emphasizing this distinction: they must understand that crypto is highly speculative and inherently volatile, meaning the potential for both rapid gains and catastrophic losses is significant.

Speculation and Risk: Cryptocurrencies are far more speculative than stocks. While traditional equities can be analyzed through financial statements and industry trends, crypto valuations often hinge on adoption rates, network activity, and public sentiment. This unpredictability creates enormous upside potential, but it also exposes investors to sudden, severe losses. Emphasizing risk management, position sizing, and emotional discipline is critical for anyone exploring crypto.

Utility and Network Effects: The real value of a cryptocurrency depends on its purpose and network. For example, Bitcoin functions primarily as a digital store of value, while Ethereum enables smart contracts and decentralized applications. Network effects occur when more participants join and use the system, increasing its value. Teaching readers to evaluate utility means asking: Does this token solve a real problem, enable transactions, or provide an essential infrastructure service? Without utility or adoption, even the most hyped token can collapse.

Market Sentiment, Regulation, and Technological Shifts: Crypto markets are highly sensitive to external influences. Regulatory announcements, technological upgrades (like Ethereum’s transition to proof-of-stake or Layer-2 scaling solutions), and interoperability improvements can dramatically alter valuations. Investors need to understand that in crypto, perception often drives price just as much as fundamental use cases. Incorporating awareness of these factors into decision-making helps anticipate moves before they happen.

Understanding Value: Because you favor deep conceptual reasoning, it’s essential to teach readers to ask: Why does this coin have value? Unlike stocks, crypto rarely has conventional financial statements. Value comes from adoption, scarcity, network security, and potential for future utility. Critical thinking about underlying use cases is vital to avoid falling for hype-driven speculation.

Risk of Total Loss: Investors must acknowledge that cryptocurrencies carry a higher probability of total loss compared to traditional assets. Security breaches, regulatory crackdowns, or project failures can render a token worthless overnight. Therefore, crypto should typically occupy only a small portion of a diversified portfolio unless the investor has an exceptionally high risk tolerance and is willing to actively manage exposure.

Key Crypto Concepts to Teach

Market Capitalization: Market cap is calculated as supply × price and provides a sense of scale for the cryptocurrency. Large-cap coins like Bitcoin and Ethereum are generally less volatile and have more liquidity, while small-cap coins can experience massive swings but also carry higher risk. Understanding market capitalization helps investors contextualize risk, potential growth, and relative stability within the crypto ecosystem.

Utility / Tokenomics: Tokenomics refers to the economic design of the cryptocurrency. This includes factors like staking rewards, network fees, governance mechanisms, and total supply limits. Teaching readers to evaluate tokenomics means helping them understand what drives demand for a token and how incentives are aligned for users, developers, and investors. Well-structured tokenomics can sustain long-term network activity, while poorly designed tokenomics may lead to inflation, manipulation, or collapse.

Ecosystem Growth: A cryptocurrency’s potential often depends on the growth of its ecosystem. This includes developer adoption, decentralized applications, partnerships, and real-world integration. Coins that are widely used for real transactions, smart contracts, or decentralized finance solutions have a stronger foundation for long-term value. Educating readers on ecosystem metrics helps differentiate between hype and sustainable projects.

Regulation & Security Risk: Crypto markets are uniquely exposed to regulatory actions and cybersecurity threats. Exchanges can be hacked, smart contracts can fail, and governments can impose restrictions that affect price. Investors must consider these risks before allocating capital, and incorporate strategies for mitigating losses, such as secure wallets, diversified holdings, and adherence to regulatory guidelines.

Volatility & Psychology: The psychological dimension of crypto investing is crucial. Prices can move dramatically within hours, often driven by sentiment rather than fundamentals. Emotional discipline, patience, and pre-defined risk management rules are necessary to avoid impulsive decisions. Teaching readers to anticipate volatility and manage their reactions can prevent significant financial and psychological damage.

Top 4 crypto coins to invest (with value rationale)

Top 4 Crypto Coins to Invest (with Value Rationale)

Here are four cryptocurrency assets that I evaluate as particularly interesting for educational purposes and for potential inclusion in a diversified digital asset basket. These selections highlight both established leaders and innovative projects with unique use cases. It’s important to note that this is not personal financial advice but rather an analysis to guide understanding of value, growth potential, and risk in the crypto space.A) Bitcoin (BTC)

Why I Include It:

Bitcoin remains the undisputed “anchor” of the cryptocurrency ecosystem. It is widely recognized as the first successful digital currency and consistently appears in commentary as the foundational holding for any crypto portfolio. Its longevity and adoption by both retail and institutional investors give it credibility unmatched by most other digital assets. Analysts and educational sources, including Money and CryptoVantage, frequently recommend understanding Bitcoin first before exploring more speculative coins.Value Case:

Bitcoin’s market capitalization is the largest among cryptocurrencies, making it a primary benchmark for the market. Its track record demonstrates resilience through multiple cycles of boom and bust, and its wide adoption as a store of value has earned it the nickname “digital gold.” Investors often view it as a hedge against currency inflation and a foundational pillar for crypto diversification.Growth Potential:

Despite being a mature cryptocurrency, Bitcoin still has room to grow. Institutional adoption, clearer regulatory frameworks, and integration into traditional financial systems can all drive price appreciation. While Bitcoin’s potential gains may be less explosive than smaller altcoins, it is often considered a relatively safer long-term digital asset.Risk:

Being a large-cap cryptocurrency, Bitcoin’s upside is often more muted compared to smaller, emerging coins. Additionally, it remains susceptible to crypto market cycles, macroeconomic sentiment, and regulatory shifts that can create volatility. Investors must understand that while it is relatively stable within crypto, Bitcoin is not immune to market downturns.B) Ethereum (ETH)

Why I Include It:

Ethereum is the leading smart-contract platform with a large and active developer ecosystem. Its utility extends beyond mere currency — it powers decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). Ethereum is often recommended by sources such as Business Insider for its pivotal role in Web3 infrastructure.Value Case:

Ethereum benefits from the growth of DeFi, NFTs, and the broader Web3 movement. Its platform enables developers to create a variety of decentralized applications, which increases network usage and token demand. Furthermore, upgrades such as Ethereum 2.0, which improve scalability and energy efficiency, provide structural support for long-term value creation.Risk:

Ethereum faces significant competition from alternative layer-1 blockchains that promise faster transaction speeds or lower fees. Scaling challenges, high gas costs during peak usage, and its already elevated valuation could limit upside if competitors capture market share or technological improvements fall short.C) Solana (SOL)

Why I Include It:

Solana has frequently been highlighted as one of the top cryptos to watch in 2025 due to its exceptional transaction speed, extremely low fees, and growing developer traction. Analysts, including Money, cite it as a promising platform for high-throughput applications and fast-growing decentralized networks.Value Case:

Solana’s ecosystem continues to expand with new projects, developer engagement, and decentralized applications. Its technical advantages, including rapid block times and low costs, make it attractive for applications such as gaming, DeFi, and Web3 adoption. If the ecosystem maintains momentum and continues attracting developer mind-share, Solana could see meaningful upside.Risk:

Solana has experienced technical outages in the past, highlighting the risks inherent in high-performance blockchain infrastructure. Additionally, competition is fierce, and the coin remains speculative; adoption rates and ecosystem growth must continue to justify long-term value. Investors must be prepared for potential volatility.D) Chainlink (LINK)

Why I Include It:

Chainlink serves as a critical infrastructure layer in the crypto ecosystem, providing decentralized oracles that connect blockchain networks with real-world data. While it may not have the glamour of consumer-facing coins, it plays a foundational role in DeFi, tokenized assets, and smart contract execution. Its significance makes it a key project to understand.Value Case:

As tokenized assets and blockchain integration with real-world data grow, Chainlink’s oracles are increasingly essential. The network’s reliability, security, and adoption by major projects position LINK for potential long-term value, especially as DeFi and other blockchain use cases expand.Risk:

Chainlink’s value is dependent on the continued growth and adoption of blockchain infrastructure. If the expansion of DeFi, tokenized assets, or smart contract use slows, LINK could underperform. Additionally, platform-specific risks, including technological execution or competition from alternative oracle networks, must be considered by investors.Integrating Stocks + Crypto in a Portfolio

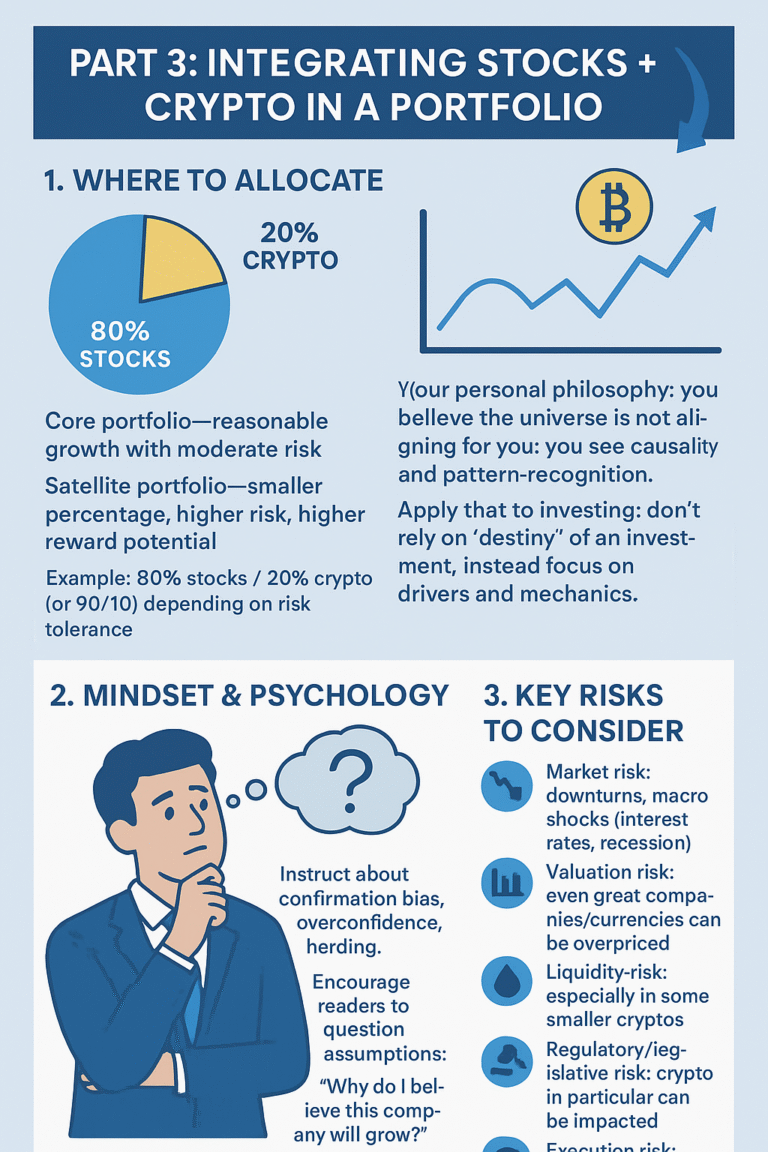

Where to Allocate

Building a portfolio that combines both stocks and cryptocurrencies requires a clear understanding of the different risk and return characteristics of each asset class. Stocks generally form the core of an investment portfolio, offering reasonable growth potential with moderate risk, while crypto assets act as a satellite portfolio with higher risk and higher reward potential. Allocating thoughtfully ensures that the investor can capture upside opportunities without exposing the entire portfolio to extreme volatility.Stocks:

As the core component, stocks provide stability and reliable long-term growth. They represent ownership in companies with cash flows, earnings, and a tangible path to value creation. While individual stock performance can fluctuate, the overall portfolio benefits from diversification across sectors, industries, and geographies, which reduces idiosyncratic risk.Crypto:

The cryptocurrency portion of the portfolio serves as an optionality play. With smaller allocations, crypto allows exposure to potentially explosive growth opportunities, emerging technologies, and innovative ecosystems. However, this comes at the cost of extreme volatility, regulatory uncertainty, and a higher risk of total loss. Crypto should never constitute the majority of a portfolio unless the investor has both the risk tolerance and experience to handle its fluctuations.Example Allocation:

A balanced starting point could be 80% stocks and 20% crypto, or for more conservative investors, 90% stocks and 10% crypto. These ratios should be adjusted based on personal risk tolerance, investment horizon, and comfort with volatility. The key is intentional allocation, not random guessing.Provide Re-Balancing Discipline:

As crypto can fluctuate dramatically in short periods, the portfolio may drift from its intended allocation. When crypto surges, it could exceed its planned percentage, increasing risk exposure. Investors should periodically rebalance by taking profits, reallocating to stocks, or reinvesting to maintain target allocation. Rebalancing enforces discipline and reduces emotional decision-making.Mindset & Psychology

Investing successfully is as much about mental frameworks as it is about technical analysis. Your personal philosophy — rejecting mystical explanations and focusing on causality and pattern recognition — should be at the center of teaching this discipline. Readers should understand that no investment succeeds because of luck or alignment with fate; it succeeds due to identifiable drivers and mechanics.Confirmation Bias, Overconfidence, and Herding:

Investors often fall prey to psychological traps. Confirmation bias leads them to favor information that supports pre-existing beliefs, while overconfidence can cause excessive risk-taking. Herding behavior drives decisions based on the actions of others rather than fundamental analysis. Teaching readers to identify and resist these tendencies is critical for rational decision-making.Rational Discipline:

Emphasize research, risk management, and avoidance of impulsive trades. Every investment decision should be grounded in analysis and logical reasoning rather than emotion or hype. Encourage systematic evaluation of drivers, potential outcomes, and contingency plans. Discipline is what separates successful long-term investors from those who chase trends and lose capital.Key Risks to Cover

Market Risk:

Broader economic conditions, such as recessions, inflation spikes, or interest rate changes, can impact both stocks and crypto. Investors must be aware that macro shocks can temporarily or permanently affect portfolio value, and should consider defensive positioning and diversification to mitigate these risks.Valuation Risk:

Even fundamentally strong companies or cryptocurrencies can be overpriced. Buying assets at excessive valuations limits potential upside and increases downside risk if expectations fail to materialize. Teaching readers to interpret metrics, compare historical trends, and understand market sentiment is crucial.Liquidity Risk:

Smaller cryptocurrencies or less-traded stocks may face liquidity challenges. Difficulty in selling or exiting positions during market stress can amplify losses and prevent timely portfolio adjustments. Investors should ensure adequate liquidity in all holdings.Regulatory/Legislative Risk:

Particularly relevant to crypto, regulatory shifts can dramatically affect asset value. Governments may impose restrictions, tax changes, or outright bans, which could cause rapid devaluation or limit usability. Awareness and monitoring of regulatory developments are critical.Execution Risk:

The business or token model may fail to perform as expected. For stocks, this could mean a failed product launch, management missteps, or competitive disruption. For crypto, smart contracts or network adoption may underperform, undermining value. Understanding operational and technological risk is essential.Emotional Risk:

Investors are prone to react emotionally during market volatility — becoming greedy during surges and panicking during declines. Teaching readers to manage emotions, adhere to allocation strategies, and maintain long-term perspective is vital for investment resilience.

Summary & Take-aways

Investing Philosophy:

Investing is not about finding quick wins or attempting to “pick the next overnight success.” Rather, it is a disciplined process focused on selecting high-quality opportunities, managing risk effectively, and committing to a long-term investment horizon. Success comes from rational evaluation, careful allocation, and emotional discipline, not luck or hype. Your audience should understand that wealth accumulation in markets is a systematic exercise in probability and cause-and-effect analysis.Stocks:

When focusing on stocks, guide readers to choose companies with durable business models, clear growth potential, and reasonable valuations. Durable business models mean the company has a lasting competitive advantage — a moat — that can protect profits over time. Growth potential refers to the ability of the company to expand revenues, market share, or profitability in a measurable way. Reasonable valuation ensures that investors are not overpaying, which could limit upside and increase downside risk. By combining these factors, readers can build a stock portfolio grounded in evidence-based investing principles.Crypto:

For cryptocurrencies, focus on tokens with demonstrable utility and growing ecosystems. This includes tokens that facilitate real-world applications, smart contracts, decentralized finance, or critical infrastructure roles. However, emphasize that crypto is inherently highly volatile and speculative, and even promising projects carry significant risk. Your readers should treat crypto as a satellite allocation in their portfolio, designed to capture potential high returns without jeopardizing core capital.Portfolio Integration:

The most effective strategy combines stocks and crypto into a single, coherent portfolio, with careful attention to weightings and periodic rebalancing. Stocks provide stability and consistent growth, while crypto adds optionality and high-upside potential. Regularly reviewing allocations ensures that no single asset class dominates and that risk remains aligned with the investor’s tolerance and long-term goals. Teaching readers to maintain a disciplined balance between these components is crucial for sustainable success.Causal Thinking:

Above all, encourage your audience to think causally rather than mystically. Instead of hoping an investment “goes to the moon,” teach them to analyze what drives value, whether it’s revenue growth, adoption rates, technological innovation, or network effects. This mindset fosters logical decision-making, reduces susceptibility to hype, and ensures that investment actions are grounded in reality.Risk Awareness & Mindset:

Reinforce that no investment is guaranteed. Losses will happen, and volatility is part of the process. What matters most is discipline, adherence to a structured methodology, and maintaining a rational mindset. By focusing on process over outcomes, your readers can cultivate long-term success, improve decision-making, and treat investing as a controlled, evidence-driven endeavor rather than a gamble.