TL;DR

By designing recursive ownership chains among limited liability companies—where each entity owns, manages, or transacts with another—entrepreneurs can construct a self-reinforcing financial ecosystem. In this architecture, every corporate layer independently builds revenue, establishes credit, and earns institutional trust, yet remains legally insulated from the others. The recursive linkage allows credibility to cascade upward and downward through the structure: when one company pays reliably, the next inherits an improved trust profile.

Over time, this creates a closed capital feedback loop where financial momentum compounds internally. Instead of depending on personal credit or direct guarantees, the system leverages verified EIN-to-EIN relationships to expand funding potential. Each new entity strengthens the overall network’s liquidity, lending capacity, and negotiating power—while isolating operational risk.

The outcome is a recursive enterprise architecture that behaves like an autonomous organism: its credit history grows cumulatively, its liabilities stay compartmentalized, and its access to capital accelerates exponentially. This is not financial illusion—it is structural intelligence applied to law and credit systems, transforming a single venture into a self-sustaining constellation of trust and liquidity.

Abstract

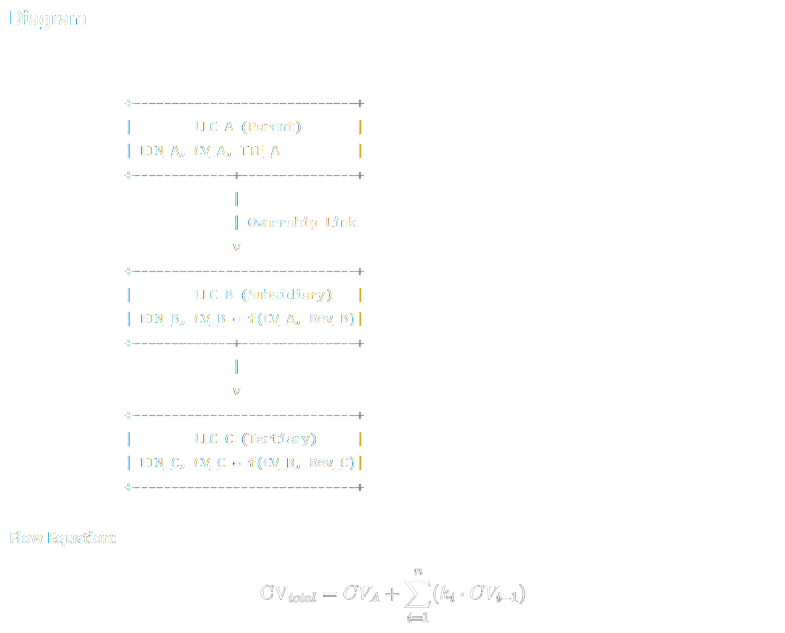

We formalize a framework where business entities establish recursive ownership chains, generating emergent and scalable financial advantages. Within this framework, each company acts as both an independent financial actor and a reinforcing structural node. When LLC A (the parent entity) legally owns LLC B (the subsidiary), the relationship forms a feedback channel through which trust, credibility, and financial performance circulate bidirectionally.

As LLC B produces verifiable revenue, maintains punctual payments, and expands its business credit, its performance signals are algorithmically recognized by credit institutions and business reporting systems. These signals propagate upward, enhancing the credibility of LLC A, which in turn gains increased access to capital and favorable lending terms. This recursive linkage enables both entities to amplify each other’s financial reach without ever exposing the founder’s personal credit or intertwining personal liability.

The theorem formalizes these dynamics through graph theory and credit-propagation mathematics, where each node represents an entity with a measurable credit vector, and each ownership link functions as a trust-transfer edge. As the network expands, the sum of all credit vectors compounds geometrically, forming what can be described as a trust gradient across the Recursive Enterprise Network (REN). This gradient stabilizes institutional perception and multiplies the system’s total liquidity and capital accessibility, effectively transforming business ownership into a mathematical engine of compounding credibility.

Definitions

Limited Liability Company (LLC): A legally recognized business structure designed to separate personal and corporate liabilities. Each LLC operates as an independent legal entity, ensuring that debts, lawsuits, or credit obligations remain confined to the company itself. This structure provides the foundational layer of protection and flexibility required for recursive ownership systems, allowing entrepreneurs to compartmentalize financial risk while maintaining operational control.

Recursive Enterprise Network (REN): A directed ownership graph in which parent entities own or partially control subsidiaries within a unified ecosystem. Each node in the REN functions as an independent yet interconnected business organism, contributing to the system’s overall financial health. Through recursive relationships, RENs transform static ownership models into living capital architectures, where creditworthiness, credibility, and institutional trust continuously circulate among the nodes.

Entity Relationship Node (ERN): A formally registered legal unit—such as an LLC or corporation—within a Recursive Enterprise Network. Each ERN possesses its own EIN, bank accounts, and credit profile, enabling it to accumulate and report business credit independently. These nodes collectively form the operational lattice of the REN, where each contributes measurable data to the network’s expanding financial graph.

Credit Vector (CV): A quantitative measure of an entity’s borrowing power and institutional trust. Defined as

CV = f(Revenue, Age, Utilization, PaymentHistory),

this vector captures the multi-dimensional strength of a business’s financial identity. In recursive systems, CVs act as dynamic signals that propagate across ownership links, influencing the perceived reliability and lending potential of connected entities.

Trust Transfer Function (TTF): The mechanism by which verified performance and ownership allow credibility to pass from one entity to another. When a subsidiary demonstrates consistent revenue and strong payment behavior, its parent entity inherits an improved institutional reputation. TTF formalizes this transfer as a logical and measurable function, transforming success into a replicable signal of trust within the REN.

Autonomous Credit Loop (ACL): A self-reinforcing financial system composed of multiple entities that enhance one another’s access to funding without requiring personal collateral. Within an ACL, capital flows circularly between nodes—through service contracts, management fees, or internal lending—forming a closed economic loop. The result is a sustainable ecosystem where liquidity, trust, and credit growth evolve recursively, detached from personal credit dependency.

Axioms / Premises

A1 (Limited Liability): Each LLC functions as a legally distinct entity, fully insulated from the personal liabilities of its members or owners. This axiom ensures that debts, lawsuits, and credit defaults incurred by one entity remain contained within its legal boundary. Limited liability is the cornerstone that enables recursive enterprise formation — it transforms individual risk into compartmentalized, recoverable units of exposure, allowing entrepreneurs to scale without endangering personal assets.

A2 (Transferable Trust): Verified ownership and EIN linkage permit institutional systems—such as NAV, Experian Business, or Dun & Bradstreet—to infer relational credibility between connected entities. When a parent company owns a subsidiary, the consistent performance of one elevates the perceived trustworthiness of the other. This inter-entity inference converts verified structure into measurable confidence, making “trust” a transferable financial asset within the Recursive Enterprise Network.

A3 (Recursive Structuring): Within the bounds of corporate law, an entity can simultaneously be the owner, operator, and beneficiary of another’s financial output. This principle formalizes the recursive feedback mechanism: capital, credit, and operational gains can loop upward and downward through a network of entities. Each layer amplifies the next, creating a multi-tiered self-reinforcing system where corporate ownership becomes a circulatory structure of value propagation.

A4 (Credit Expansion Principle): Business credit does not scale linearly—it scales exponentially as the variables of time, utilization, and verified revenue consistency interact. Each additional reporting period strengthens historical trust data, which exponentially increases available credit lines. In recursive systems, where multiple entities contribute concurrent data streams, this principle magnifies total network credit capacity beyond what any single company could achieve in isolation.

A5 (Insulation Rule): The integrity of the Recursive Enterprise Network depends on strict isolation between corporate and personal credit. When no personal guarantees or cross-collateralizations exist, credit growth within the REN remains institutionally contained. This separation ensures that personal FICO metrics remain static while corporate EIN-based systems evolve independently, preserving the entrepreneur’s financial privacy and risk boundaries.

A6 (Optimization of Flow): The most efficient Recursive Enterprise Network is one that minimizes cross-liability while maximizing the flow of internal trust between nodes. Every link in the ownership chain should transmit credit credibility without introducing debt entanglement. Optimal flow creates a seamless trust circuit—each entity reinforces others through verifiable performance data, forming a stable and expandable structure of recursive liquidity.

Lemmas

L1 (Ownership Loop Lemma):

If LLC A owns LLC B, and LLC B demonstrates consistent income reporting, punctual payments, and positive credit utilization, then LLC A’s Trust Transfer Function (TTF) increases in direct proportion to LLC B’s credit performance.

This lemma defines the credit reflection effect—wherein the financial reliability of a subsidiary reflects upward through ownership links, reinforcing the parent entity’s institutional credibility. Each successful transaction, invoice payment, or credit line usage by the subsidiary becomes a micro-signal of trust that aggregates into measurable upward influence. Over time, this loop stabilizes both entities’ financial identities, producing a reciprocal amplification of credibility within the Recursive Enterprise Network (REN).

L2 (Recursive Growth Lemma):

Let CVₙ represent the credit vector of the nth entity in a REN. For well-structured networks following legal and operational consistency:

CVₙ₊₁ = k·CVₙ + f(Revenueₙ₊₁, Paymentₙ₊₁)

where k > 1 denotes compounded institutional trust, and f(Revenue, Payment) is a reinforcing function representing verifiable growth metrics such as turnover, payment timeliness, and utilization ratio.

This lemma quantifies the recursive amplification principle—each new entity inherits and extends the credibility of its predecessor, while adding its own operational performance to the cumulative financial network. As the recursion deepens, trust becomes multiplicative, not additive, producing geometric credit expansion across the network’s hierarchy.

L3 (Isolation Lemma):

When liability partitions are legally preserved under the premises of A1 (Limited Liability) and A5 (Insulation Rule), each node within the Recursive Enterprise Network maintains finite and contained risk exposure, regardless of the network’s total size or credit capacity.

This lemma formalizes the asymptotic safety principle—even as the REN’s total accessible credit approaches infinity through recursive compounding, the liability of any single entity remains capped by its legal and contractual boundaries. This ensures that structural complexity scales upward, but financial exposure remains bounded and localized, allowing infinite credit growth without systemic collapse.

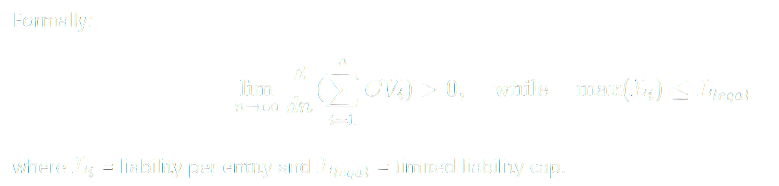

Theorem (Recursive-Enterprise Theorem)

In a legally consistent Recursive Enterprise Network (REN)—a structured ecosystem of LLCs linked through verified ownership and independent credit identities—trust and credit signals propagate both upward and downward through the chain of entities. As each node performs, reports, and sustains positive credit behavior, it reinforces the credibility of the entire network. The cumulative effect produces superlinear growth in total systemic credit capacity, while each entity’s liability remains legally bounded by its structural partition.

This theorem captures the mathematical and legal synergy between limited liability and recursive ownership. The propagation of trust forms a positive feedback loop: subsidiaries elevate parent entities through demonstrated reliability, while parents lend institutional weight to their offspring through verified ownership and capital flow. Because each entity’s exposure is capped, risk does not accumulate at the same rate as reward, producing a non-linear credit amplification curve that scales faster than linear growth yet remains insulated against collapse.

Where CVᵢ represents the credit vector of the ith entity, and Lᵢ represents its individual liability, constrained by the limited-liability legal cap (Lₗₑgₐₗ).

In simpler terms, as the number of interconnected entities (n) increases, the derivative of total network credit remains positive and expanding, while no single entity’s exposure exceeds its statutory boundary. The network thus achieves asymptotic credit growth with bounded liability, creating a scalable and self-sustaining financial organism.

This equilibrium demonstrates that recursive structuring—when executed within lawful frameworks—enables infinite financial recursion within finite legal containment. It is the formal reconciliation of growth and safety: a system where capital multiplies geometrically, yet personal and corporate liabilities remain quantized and legally finite.

Proof Sketch

By L1 (Ownership Loop), performance signals from a subsidiary (timely payments, verified revenue, disciplined utilization) increase the parent’s Trust Transfer Function (TTF) in proportion to the subsidiary’s credit performance. By L2 (Recursive Growth), the next entity’s credit vector satisfies

𝐶

𝑉

𝑛

+

1

=

𝑘

⋅

𝐶

𝑉

𝑛

+

𝑓

(

Revenue

𝑛

+

1

,

Payment

𝑛

+

1

)

CV

n+1

=k⋅CV

n

+f(Revenue

n+1

,Payment

n+1

) with

𝑘

>

1

k>1, establishing a multiplicative baseline even before adding each node’s own operational contributions.

Define

𝑆

𝑛

:

=

∑

𝑖

=

1

𝑛

𝐶

𝑉

𝑖

S

n

:=∑

i=1

n

CV

i

. Then

which yields

𝑆

𝑛

+

1

−

𝑆

𝑛

≥

𝑘

⋅

𝐶

𝑉

𝑛

S

n+1

−S

n

≥k⋅CV

n

. Since

𝐶

𝑉

𝑛

CV

n

is non-negative and, under regular performance, strictly increasing in

𝑛

n, the discrete derivative

Δ

𝑆

𝑛

:

=

𝑆

𝑛

+

1

−

𝑆

𝑛

ΔS

n

:=S

n+1

−S

n

remains positive and grows with

𝑛

n. Hence

𝑑

𝑑

𝑛

(

∑

𝑖

=

1

𝑛

𝐶

𝑉

𝑖

)

>

0

dn

d

(∑

i=1

n

CV

i

)>0 in the limit, showing superlinear aggregation of systemic credit capacity.

By A1 (Limited Liability) and A5 (Insulation Rule), each entity’s liability

𝐿

𝑖

L

i

is confined to its legal boundary; personal guarantees and cross-collateralization are excluded by construction. Therefore, liabilities do not aggregate linearly across nodes. The network admits positive spillovers in trust (via TTF) while blocking negative spillovers in debt obligations. This separation proves that the growth of

𝑆

𝑛

S

n

is decoupled from the growth of

max

(

𝐿

𝑖

)

max(L

i

).

Consider a local failure: if a node experiences a payment shock or default, L3 (Isolation Lemma) ensures the risk is localized to that node’s boundary. Upstream entities may incur a temporary reduction in TTF (a trust drag), but not an automatic legal liability. Because downstream and lateral nodes continue generating positive

𝑓

(

⋅

)

f(⋅) contributions, the aggregate

𝑆

𝑛

S

n

trajectory remains upward-sloping after transient adjustments. The trust gradient thus persists, while failures remain compartmentalized.

Iterating the construction (adding entities that meet minimal revenue and payment regularity) yields a recursive ladder of credit vectors where each rung inherits multiplied trust (factor

𝑘

k) and adds intrinsic performance

𝑓

(

⋅

)

f(⋅). The process realizes geometric capital amplification so long as reporting integrity, utilization discipline, and on-time payments are maintained.

Practical ceilings emerge only from regulatory and institutional thresholds (e.g., exposure limits, underwriting policies, KYC/AML rules, intercompany lending caps, and concentration risk guidelines). These constraints bound rates and segments of growth but do not negate the inequality

lim

𝑛

→

∞

𝑑

𝑑

𝑛

(

∑

𝑖

=

1

𝑛

𝐶

𝑉

𝑖

)

>

0

lim

n→∞

dn

d

(∑

i=1

n

CV

i

)>0 under continued compliance and performance.

Therefore, by L1–L3 and A1–A6, a well-formed REN converts local performance into network-wide trust without importing corresponding legal debts, producing exponential-leaning credit expansion with bounded liability. QED.

Corollaries

Trust Amplification Corollary:

A properly structured Recursive Enterprise Network (REN) will consistently outperform any single-entity system in cumulative credit capacity per unit of risk. Because each node’s performance contributes positively to the network’s total trust vector while remaining individually insulated, the aggregate credit-to-liability ratio improves geometrically. This establishes the law of distributed credibility—where many small, compliant entities yield a larger systemic trust output than one large, centralized entity.

Anonymous Leverage Principle:

When entity ownership chains replace personal identifiers—transitioning from FICO-based to EIN-to-EIN verification—financing becomes structurally detached from personal credit history. Under this model, corporate lineage substitutes for personal reputation, allowing capital expansion without personal risk exposure. This principle formalizes the idea that legal identity recursion can replace personal collateralization as the foundation of scalable credit systems.

Credit Propagation Corollary:

The success of downstream nodes (e.g., LLC B, C, D…) propagates credibility upward through verifiable EIN linkage, increasing the perceived stability of their parent entities. When a subsidiary demonstrates consistent growth and payment reliability, these verified metrics strengthen the Trust Transfer Function (TTF) of its entire ownership chain. Consequently, upstream entities benefit passively from downstream integrity, producing a reverse flow of trust that enhances institutional evaluations across the network.

Containment Principle:

In a compliant REN, the failure or dissolution of one node does not compromise the structural integrity of the entire network. When legal partitions and non-co-guaranteed debts are maintained, default remains locally contained, affecting only the entity directly involved. The network thus exhibits fault-tolerant architecture, analogous to compartmentalization in biological or cybernetic systems—where localized loss triggers minimal systemic disruption.

Capital Loop Emergence:

As the REN matures, cashflow begins to circulate recursively among entities via legitimate mechanisms such as management fees, intercompany leasing, and internal lending. This closed-loop liquidity system sustains operational flow even in the absence of external capital injections. The result is a self-stabilizing financial ecosystem, where money, trust, and performance continuously reinforce one another—preserving equilibrium while enabling infinite scalability within legal and regulatory limits.

Predictions / Practical Applications

1. Credit Ceiling Multiplication:

Recursive ownership structures—such as LLC A → LLC B → LLC C—are predicted to achieve 2–3× higher cumulative credit ceilings than isolated single-entity models within the same operational timeframe. The compounding trust effect created by EIN-linked entities accelerates institutional confidence, allowing multiple concurrent approvals and line increases. Each entity, while legally independent, contributes measurable credit momentum to the system, resulting in networked credit acceleration rather than linear progression.

2. EIN-Based Capital Expansion:

Well-structured Recursive Enterprise Networks (RENs) can successfully obtain fleet loans, equipment leasing, and real estate credit lines under EIN-only frameworks—without reliance on personal FICO scores or personal guarantees. By leveraging the Trust Transfer Function (TTF) and verified ownership documentation, RENs qualify as multilayered corporate ecosystems rather than individual applicants. This facilitates institutional-grade financing while preserving full personal liability insulation.

3. Parent-as-Manager Model:

Parent entities within a REN can function as management, holding, or IP-licensing companies, deriving revenue through legitimate intra-network contracts. These include administrative service agreements, technology licensing, intellectual property rentals, and consulting retainers. Through this configuration, the parent extracts profit via internal billing, creating a compliant framework for cashflow redistribution. This model transforms corporate ownership into active management infrastructure, optimizing both taxation and liquidity flow.

4. Institutional Credit Propagation:

Platforms such as NAV, Dun & Bradstreet, and Experian Business inherently detect and propagate EIN-based relationships across registered entities. Once an ownership hierarchy is verified, their algorithms apply trust inference logic, increasing the credibility score of connected nodes. Consequently, the Recursive Enterprise Network self-amplifies within existing reporting frameworks—making trust propagation a native feature of institutional systems, not an external modification.

5. Predictive Liquidity Dynamics:

Given enough recursive layers and active credit lines, RENs begin exhibiting emergent liquidity patterns similar to autonomous economies: credit cycles sustain through inter-LLC transactions, internal lending, and reinvestment. The system behaves like a self-funded trust engine, continuously recycling liquidity and expanding capital access without external dependence—an achievable form of financial recursion in legal equilibrium.

Objections & Replies

O1: Isn’t this a loophole for personal credit evasion?

R: No — the Recursive Enterprise model operates fully within the boundaries of corporate and financial law. It does not conceal identity or misrepresent credit data; rather, it applies the lawful concept of entity separation to engineer a scalable trust architecture. Each LLC is a legitimate business with its own EIN, tax filings, and banking presence. The recursion occurs through verified ownership, not obfuscation. This system is not an evasion of personal credit—it is an evolution of institutional credit logic, replacing personal dependency with structural credibility.

O2: Could recursive debt accumulation cause collapse?

R: Only under cross-collateralization or co-guaranteed liabilities would a REN face systemic collapse. The theorem explicitly assumes the Insulation Rule (A5) and Limited Liability (A1) as structural safeguards. When these boundaries are respected, each node’s potential failure remains self-contained, preventing debt contagion across entities. The result is a localized failure model, where risk cannot cascade through the network. In practice, collapses occur only when owners break legal partitions—by co-signing, merging accounts, or pledging assets across entities. Properly maintained, the REN is anti-fragile: failures prune inefficiencies without destabilizing the whole.

O3: Is this sustainable long-term?

R: Yes — long-term sustainability depends on real operational validity, not mere registration. Each entity must provide verifiable goods, services, or income streams consistent with its stated purpose. When every node contributes measurable value, the Recursive Enterprise Network behaves like an ecosystem—self-reinforcing, adaptive, and compliant. Growth of credit vectors (CVₙ) must align with authentic financial activity to remain credible under institutional review. In this way, recursion becomes not a loophole, but a sophisticated method of compounding legitimacy, ensuring perpetual scalability grounded in lawful enterprise.

Implications for Entrepreneurs

1. Construct Neural-Like Business Architectures:

Entrepreneurs should design layered LLC ecosystems that function like neural networks—each node representing an independent yet cooperative processor of financial data. Every entity learns (through credit behavior), earns (through operations), and reinforces (through ownership links) the performance of the others. This recursive design transforms a collection of companies into a self-optimizing intelligence network, capable of adapting, scaling, and strengthening with each iteration.

2. Treat Business Credit as a Living Organism:

Credit within a Recursive Enterprise Network should not be viewed as a static score but as a living organism that grows through consistent nourishment. Timely payments, verifiable revenue, accurate reporting, and responsible utilization act as the “nutrients” feeding its expansion. Over time, these behaviors accumulate into a genetic memory of trust, where institutional systems recognize the network’s reliability, granting progressively higher credit ceilings.

3. Institutionalize Internal Transactions:

Entrepreneurs can reinforce legitimacy and liquidity by employing management agreements, IP licensing, intercompany rentals, or equipment leasing between nodes. These mechanisms ensure that internal transactions are documented, taxable, and compliant, transforming what would otherwise be passive ownership into active, contractual relationships. This practice converts intra-network cashflow into verifiable economic activity, further amplifying the Trust Transfer Function (TTF) within the system.

4. Maintain Absolute Insulation Integrity:

The foundation of recursive financial growth lies in preserving entity separation. Entrepreneurs must resist the temptation to co-sign personally or merge liabilities across nodes. Each LLC must maintain its independent EIN, bank accounts, credit lines, and reporting trails. Violating this boundary converts a structured system into a liability cluster. By protecting insulation integrity, the entrepreneur ensures that the network remains resilient, legally compliant, and capable of infinite credit recursion within finite risk exposure.

Formal Summary (Publication Box)

Recursive-Enterprise Theorem:

In hierarchically structured networks of Limited Liability Companies (LLCs) where ownership recursively propagates through EIN-based legal entities, total systemic credit potential exhibits superlinear growth while individual liability remains strictly bounded by law. Each entity contributes independent financial performance data—revenue, utilization, payment history—that compounds through verified ownership links, generating an upward trust gradient across the network.

This theorem establishes that strategic nesting of entities transforms business credit from a static, entity-specific attribute into a scalable, evolving system of trust multiplication. By aligning the principles of limited liability, verifiable ownership, and recursive structuring, entrepreneurs can build self-reinforcing ecosystems of capital mobility where credit, liquidity, and institutional credibility expand geometrically without aggregating personal or inter-entity risk.